Hook: “Did you know nearly 70% of people over the age of 65 will require some form of long-term care in their lifetime? Yet, most don’t even consider home health insurance until it’s too late.” Sounds stressful, right? Let’s dive into how securing this coverage now could save you—or your loved ones—a mountain of stress later.

Purpose: This post is here to unpack everything about home health insurance: what it is, why it matters for long-term care planning, and how to navigate the confusing world of policies without losing your mind.

Preview: By the end, you’ll understand why home health insurance can be a game-changer, discover actionable steps to choose the right plan, and get insider tips (plus some brutally honest truths) about navigating insurance jargon.

Table of Contents

- Why Home Health Insurance Matters

- Step-by-Step Guide to Choosing a Plan That Fits

- Best Practices for Maximizing Your Benefits

- Real-Life Example: A Success Story

- FAQs About Home Health Insurance

Key Takeaways

- Home health insurance ensures access to quality care at home, reducing hospital visits and costs.

- Selecting the right policy involves understanding your needs, budget, and the fine print.

- Proactive planning saves money and provides peace of mind for the future.

Why Home Health Insurance Matters

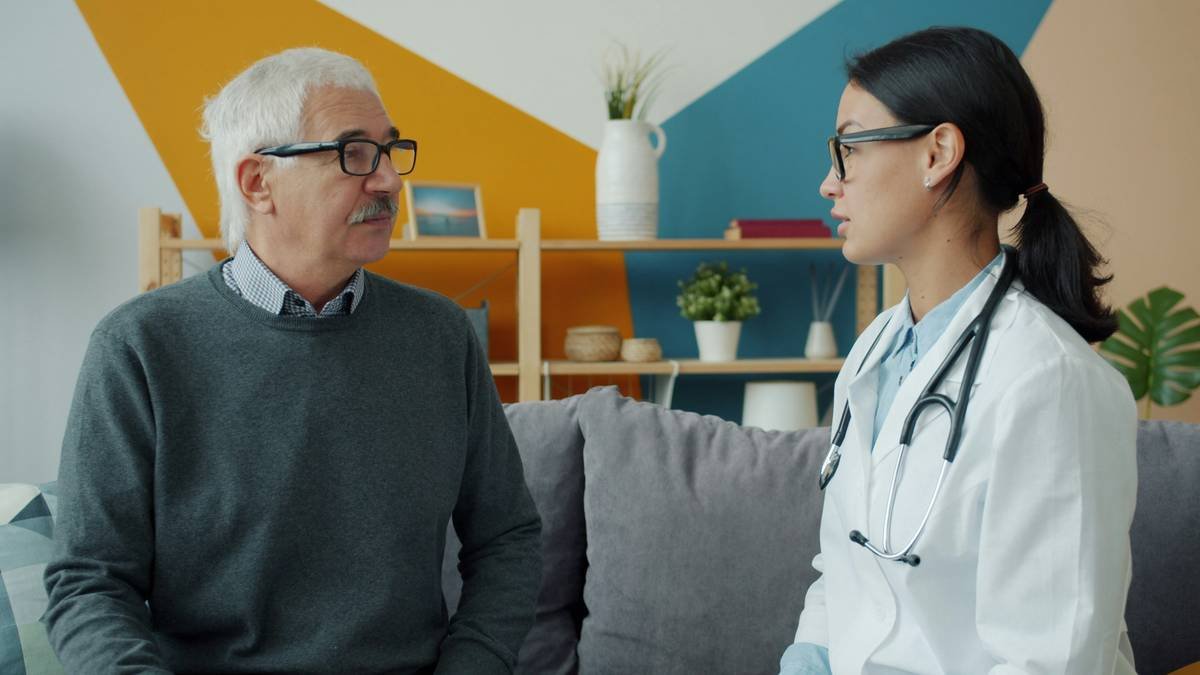

Imagine being unable to perform daily tasks like bathing or cooking due to an illness or disability. It happens more often than we think—and traditional medical plans rarely cover non-medical assistance at home. That’s where home health insurance shines. It bridges gaps by covering services such as nursing care, physical therapy, and personal aides—all delivered straight to your living room.

A confessional fail moment: I once recommended a friend look into basic health coverage instead of exploring home health options because “it sounded easier.” Big mistake. When they needed post-surgery rehab, they ended up paying thousands out-of-pocket. Lesson learned: Always explore all angles before making decisions about insurance.

Image: Statistics reveal most seniors need long-term care but neglect proper planning.

Step-by-Step Guide to Choosing a Plan That Fits

Optimist You: “This process sounds simple enough!”

Grumpy You: “Yeah, if reading legal documents gives you joy…”

Step 1: Assess Your Needs

List specific requirements based on potential scenarios. Are you worried about mobility issues? Chronic conditions? Knowing these details helps narrow options.

Step 2: Compare Coverage Details

Not all policies are created equal. Some may only offer limited hours of caregiving per week; others might include advanced therapies. Look beyond flashy ads—read the fine print!

Step 3: Crunch Numbers

Evaluate premiums versus expected benefits. High upfront costs may deter many, but remember, the goal is to avoid financial ruin later.

Step 4: Ask Questions—Lots of Them

Call insurers directly. Ask about exclusions, renewability clauses, and whether family members can use the same policy. Don’t settle until every doubt is resolved.

Best Practices for Maximizing Your Benefits

- Review Annually: Life changes fast. Ensure your policy still matches current needs.

- Leverage Bundling Discounts: Combining policies through one provider sometimes leads to cheaper rates.

- Document Everything: Keep records of claims, correspondence, and receipts. They come in handy during disputes.

Warning: One terrible tip floating around online suggests waiting until retirement age to buy home health insurance since prices drop. False! Policies become astronomically expensive—or unavailable entirely—if purchased after certain conditions arise. Don’t risk it.

Real-Life Example: A Success Story

Meet Sarah, a retired teacher who invested in home health insurance early. After falling ill with chronic obstructive pulmonary disease (COPD), she required regular oxygen therapy and nursing support. Thanks to her forward-thinking choice, Sarah got comprehensive in-home care without draining her savings. Her story proves that preparation truly pays off.

FAQs About Home Health Insurance

Q: Is home health insurance worth it?

A: Absolutely! If avoiding costly nursing homes and maintaining independence appeals to you, then yes—it’s worth every penny.

Q: Does Medicare cover home health services?

A: Yes—but with strict limitations. Private home health insurance fills those gaps effectively.

Q: How do I file a claim?

A: Contact your insurer immediately after service begins. Provide necessary documentation promptly to prevent delays.

Conclusion

Securing home health insurance isn’t just smart—it’s essential for safeguarding against unpredictable futures. Remember the importance of assessing needs, comparing policies meticulously, and staying proactive about renewals. With these strategies under your belt, you’re ready to face any challenge head-on.

And hey, treat yourself to that coffee break while reviewing contracts—it’s totally justified.

Bonus haiku:

Policy paperwork,

Confusing yet crucial—

Peace when done correctly.