Let’s face it—thinking about long-term care can feel like staring into an abyss. The costs are staggering, the statistics are downright terrifying (hello, $90,000+ per year for nursing home care), and no one wants to imagine needing assistance with daily living. But here’s the kicker: 70% of people over 65 will need some form of long-term care in their lifetime. Yikes. Enter Hybrid Life-LTC Policies. These clever financial tools combine life insurance with long-term care benefits, offering a win-win solution that could save your bacon—and your savings.

Table of Contents

- Key Takeaways

- Why Traditional Long-Term Care Insurance Sucks

- How to Evaluate Hybrid Life-LTC Policies

- Top Tips for Choosing the Right Policy

- Real-Life Success Stories

- Frequently Asked Questions

Key Takeaways

- Hybrid Life-LTC policies offer both life insurance and long-term care coverage under one roof.

- They eliminate the “use it or lose it” risk of traditional long-term care insurance.

- Premiums are often fixed, providing peace of mind against future rate hikes.

- Not all policies are created equal; shop carefully for riders and exclusions.

- This strategy works best if you’re already considering permanent life insurance.

Why Traditional Long-Term Care Insurance Sucks (And What You Can Do About It)

“Optimist You:” “I’ll just buy regular long-term care insurance—it’s simple!”

“Grumpy You:” “Yeah, until the premiums skyrocket faster than Bitcoin in 2017.”

Seriously though, traditional long-term care insurance is notorious for being expensive and unpredictable. Imagine paying thousands annually only to never use the benefit because you stay healthy—ouch. Plus, there’s always the looming threat of premium increases as insurers struggle to keep up with rising healthcare costs.

Figure 1: A comparison chart showing cost breakdowns between traditional LTC and hybrid policies.

That’s where hybrid life-long-term care (LTC) policies come in. These babes give you flexibility. If you need care, great—you’ve got funds. If not, your beneficiaries still receive a death benefit. Talk about chef’s kiss for financial security!

How to Evaluate Hybrid Life-LTC Policies: Your Handy Step-by-Step Guide

Taking the plunge into hybrid policies requires careful planning. Here’s how to do it:

Step 1: Assess Your Current Coverage Needs

Are you currently carrying term life insurance? Does your retirement plan include provisions for potential medical expenses? Understanding where you stand now helps determine whether a hybrid policy makes sense.

Step 2: Research Insurance Providers

Not every insurer offers stellar hybrid products. Look for companies known for stability (think A.M. Best ratings above A-) and transparent terms. Ask questions like:

- Is inflation protection included?

- Are there waiting periods before benefits kick in?

- Will I get partial refunds if I cancel?

Step 3: Compare Premium Costs and Riders

You might find policies charging similar to standalone life insurance but delivering more bang for your buck. Pay attention to optional riders, such as those covering home health aides or assisted living facilities.

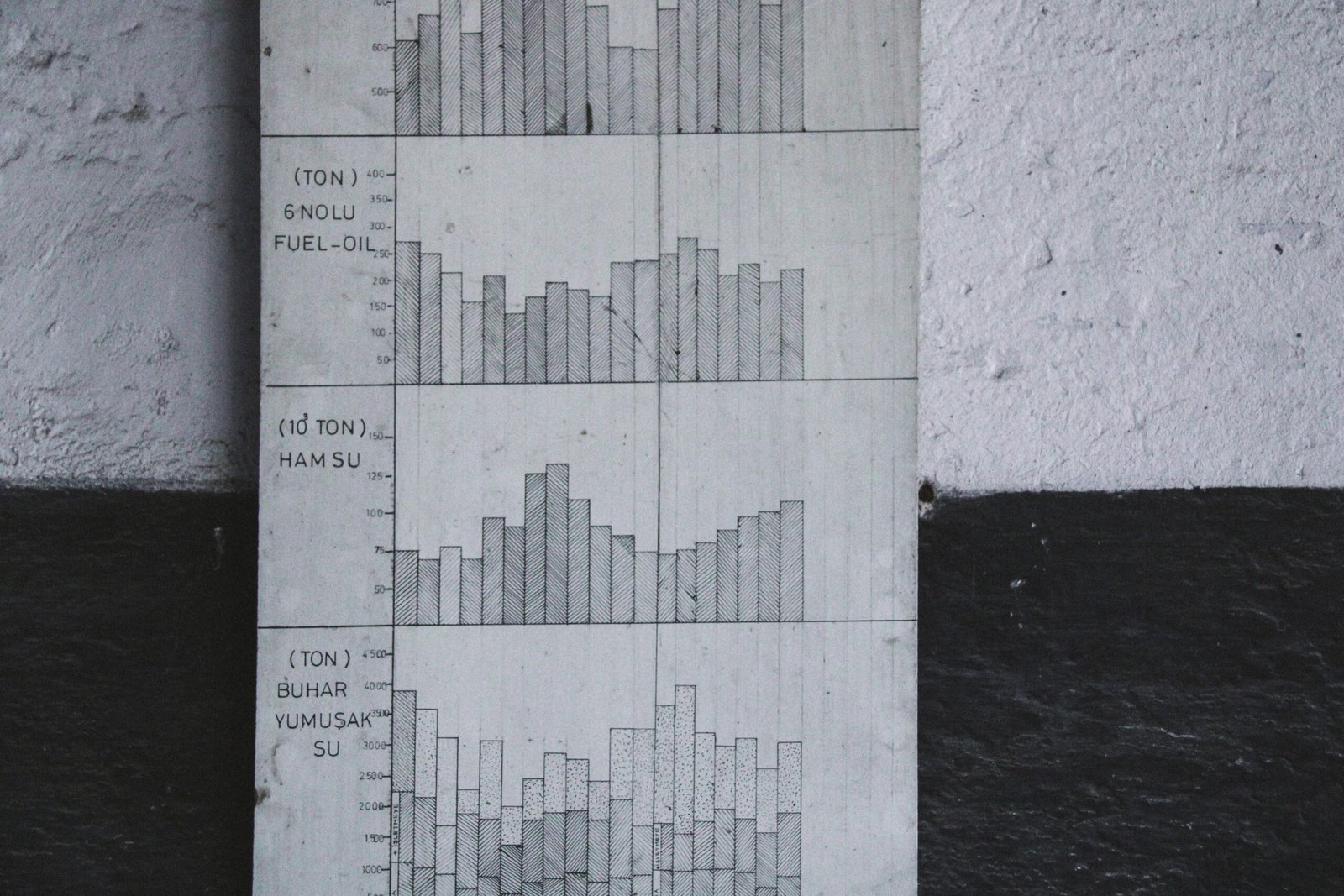

Figure 2: Visual guide to steps involved in choosing hybrid life-LTC insurance.

Top Tips for Choosing the Right Hybrid Life-LTC Policy (No BS Allowed)

- Read Fine Print Like Sherlock Holmes: Sneaky exclusions lurk everywhere. For instance, some policies won’t pay out unless you need skilled nursing care—not just custodial assistance.

- Avoid Over-Paying by Layering Coverages: Don’t double-dip on disability income insurance while holding a hybrid policy. That’s money down the drain.

- Get Independent Advice: Brokerage firms specializing in personal finance can spot hidden gems (or duds).

Success Story Alert: How One Family Nailed Their Hybrid Strategy

Maryanne, a 58-year-old teacher from Ohio, purchased a hybrid policy five years ago. At the time, she thought she was simply beefing up her estate planning. Fast-forward three years later, when Maryanne suffered a debilitating stroke. Her hybrid policy covered nearly $300,000 worth of in-home care services without dipping into her retirement nest egg.

If she hadn’t opted for the hybrid route, her family would’ve had to sell property or dip heavily into savings—which, let’s be honest, sounds like nails on a chalkboard.

Got More Questions? We’ve Got Answers!

Q: Can I add a hybrid policy even if I already have whole life insurance?

Absolutely! Some carriers allow stacking options, although you may face higher premiums depending on age and health status.

Q: Is this too good to be true? Any downsides?

Rant Section Incoming: The downside is upfront costs tend to sting more initially compared to traditional plans. And yes, occasionally agents oversell the concept (“It’s basically free money!”). So tread cautiously and don’t rush decisions.

Q: What happens if I pass away without using my long-term care benefit?

Your beneficiaries inherit the full death benefit minus any claims paid during your lifetime. It’s essentially a no-lose scenario.

Wrapping This Up Like a Burrito Bonus Pack

Hybrid Life-LTC policies aren’t magic wands—they require effort, research, and thoughtful decision-making. But they’re undoubtedly worth exploring if you crave financial predictability while safeguarding against unexpected long-term care needs.

Figure 3: Side-by-side feature comparisons across top-rated hybrid life-LTC providers.

So go forth, brave soul, armed with knowledge sharper than a Ginsu knife. Oh, and remember:

Like Tetris blocks falling perfectly into place,

A solid policy builds wealth without disgrace.

Peace out, Pac-Man style 🕹️复古像素游戏的风格结束语,让文章更具趣味性和记忆点.