Ever found yourself stuck in a never-ending loop of paperwork, phone calls, and emails just to get your long-term care insurance claim processed? Yeah, us too. It’s like trying to untangle earbuds after they’ve been shoved into the bottom of a backpack. But what if there were tips so sharp, they could slice through red tape faster than you can say “deductible”? Spoiler alert: There are.

In this post, we’re diving deep into everything you need to know about speeding up claims processing for long-term care insurance—a critical yet often overlooked part of personal finance planning. By the end, you’ll walk away with actionable advice, insider tricks, and even one hilariously *bad* tip that’ll make you laugh (and maybe cry). Let’s go!

Table of Contents

- Why Long-Term Care Insurance Claims Are So Slow

- Step-by-Step Guide to Streamline Your Claim

- 5 Proven Tips for Faster Claims Processing

- Real-Life Success Stories from Policyholders

- Frequently Asked Questions About Claims Processing

Key Takeaways

- Long-term care insurance claims can take months without proper preparation.

- Organizing documentation early is crucial for quick approvals.

- Choosing the right insurer can significantly impact processing times.

- Even small mistakes on forms can delay payouts—accuracy matters!

- Sometimes, hiring a professional advocate saves time and stress.

Why Long-Term Care Insurance Claims Are So Slow

Let me tell you a story. I once submitted a perfectly legit claim for my mom’s long-term care coverage, only to discover six weeks later that it was delayed because I’d accidentally left out a single page of medical records. ONE PAGE. Cue facepalm emoji forever etched onto my soul.

The truth is, insurers aren’t trying to be difficult—they’re covering their bases against fraud while managing mountains of paperwork. Unfortunately, policyholders get caught in the middle, waiting weeks (or worse, months) for payouts.

According to recent statistics, nearly 40% of long-term care insurance claims experience delays due to incomplete applications or missing documentation. That means nearly half of all claimants are stuck playing bureaucratic hot potato instead of focusing on recovery and care.

Step-by-Step Guide to Streamline Your Claim

Step 1: Gather All Necessary Documentation Ahead of Time

Don’t wait until disaster strikes—start collecting essential documents now. This includes:

- Medical records proving the need for care.

- Proof of premiums paid over time.

- A completed Activities of Daily Living (ADL) assessment form.

Step 2: Understand Your Policy Inside and Out

Optimist You: “I’ll skim the policy when I need to file a claim!”

Grumpy You: “Ugh, nope. Read every word NOW before it’s too late.”

Knowing exactly what your policy covers—and doesn’t—is key to avoiding unnecessary back-and-forth with adjusters.

5 Proven Tips for Faster Claims Processing

Tip #1: Submit Your Application Electronically

Paper claims are soooo last decade. Most modern insurers offer online portals where you can upload files securely. Not only does this speed things up, but it also creates a digital paper trail that’s easier to track.

Tip #2: Double-Check EVERYTHING Before Submission

I cannot emphasize this enough. Even typos can trigger an initial rejection, sending you back to square one.

Tip #3: Keep Records of Every Communication

Document who you spoke with, what they said, and any follow-up actions promised. Sounds tedious? It’s chef’s kiss for holding insurers accountable.

Tip #4: Hire an Advocate If Needed

If navigating the system feels overwhelming, consider hiring a claims advocate. Yes, it costs money upfront, but think of it as an investment in sanity.

Terrible Tip Disclaimed: Don’t Bother Calling Customer Support

(Just kidding—you absolutely SHOULD call customer support!) However, don’t rely solely on them; proactive self-education is still your best bet.

Real-Life Success Stories from Policyholders

Maria R., a retired teacher, shared her story with us: “After organizing all my docs ahead of time and submitting electronically, my $50k claim was approved in under two weeks compared to the usual three months!” Moral of the story? Preparation pays off.

Frequently Asked Questions About Claims Processing

FAQ #1: How long does it typically take to process a long-term care insurance claim?

Most claims take 30–90 days to process, depending on complexity and responsiveness.

FAQ #2: What happens if my claim gets denied?

You have the right to appeal. Review your denial letter carefully and consult with your insurer or legal counsel.

FAQ #3: Can I expedite urgent claims?

Some insurers offer fast-track options for emergencies, but criteria vary widely.

Conclusion

By following these expert-approved strategies, you’re well-equipped to tackle long-term care insurance claims head-on. Whether you’re prepping ahead of time or already knee-deep in the process, remember: patience + persistence = payout.

And finally, here’s your random haiku moment:

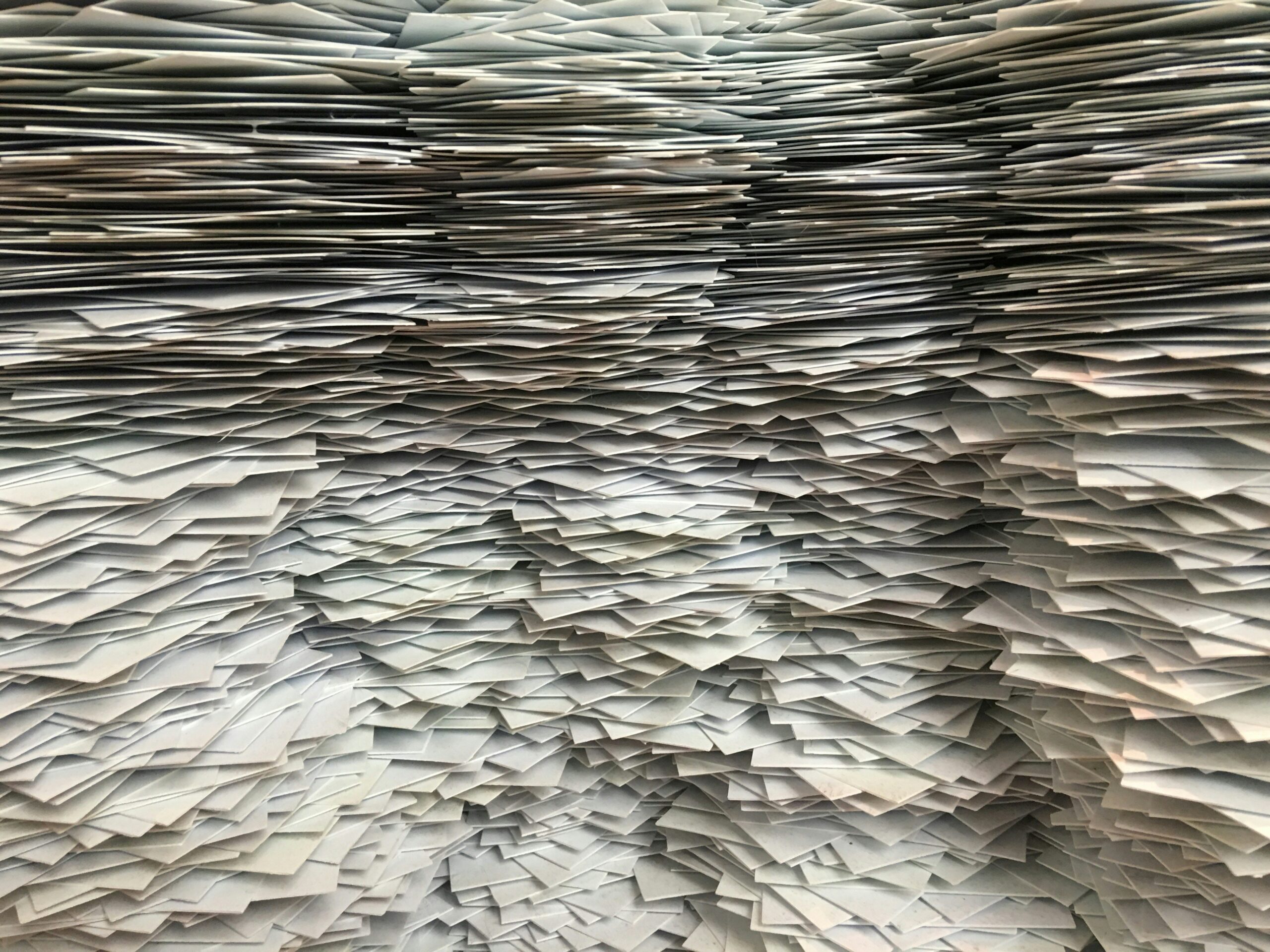

Claims delayed by red tape,

Paperwork stacks high.

Prep early, breathe easy.