Ever felt overwhelmed trying to figure out how disability support benefits tie into long-term care insurance? You’re not alone. With 70% of people over age 65 requiring some form of long-term care, navigating this financial maze feels like assembling IKEA furniture without instructions—frustrating and messy.

In this post, we’re breaking down everything you need to know about “disability support benefit” in the context of long-term care insurance. From avoiding costly mistakes (yes, I once confused my HSA for an FSA—not pretty) to actionable steps and quirky tips, you’ll walk away informed and ready to make smart decisions.

Table of Contents

- Understanding the Basics: What Is a Disability Support Benefit?

- Step-by-Step Guide to Leveraging Disability Support Benefits

- Tips & Best Practices for Maximizing Your Coverage

- Real-World Examples: Success Stories That Prove It Works

- Frequently Asked Questions About Disability Support Benefits

Key Takeaways

- A disability support benefit provides essential financial aid when illness or injury prevents you from working.

- Long-term care insurance can be enhanced using strategies tied to your disability support benefit.

- Understanding policy terms and exclusions helps avoid unexpected costs later on.

- Real-life examples show how proper planning pays off during critical life moments.

What Exactly Is a Disability Support Benefit—and Why Should You Care?

Let’s start with the basics. The “disability support benefit” is a crucial component of many long-term care policies, designed to provide ongoing income replacement if you become unable to work due to a qualifying medical condition. Think of it as a safety net—it keeps your finances stable while safeguarding against crippling debt.

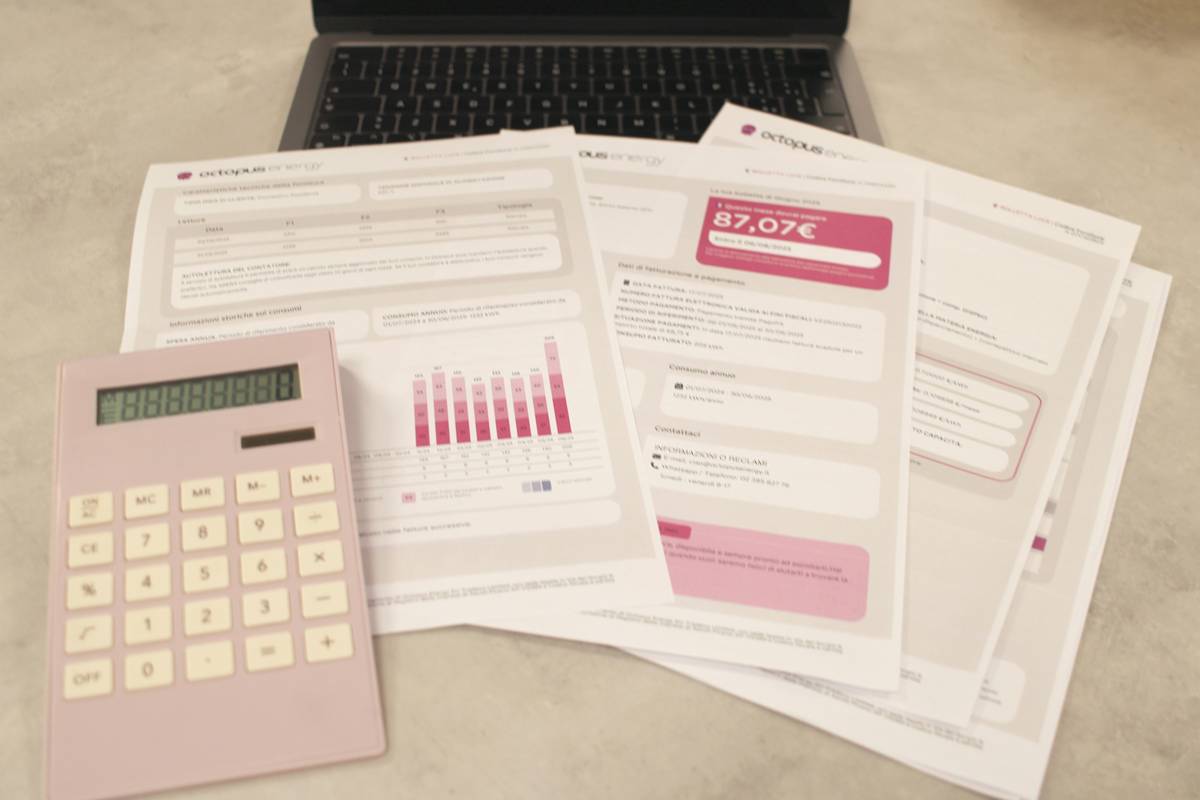

Infographic: Stats on the likelihood of needing long-term care and its financial implications.

Here’s where most folks trip up: They assume Social Security Disability Insurance (SSDI) will save them. Hate to break it to ya, but SSDI payouts often fall short, forcing families into tough choices between paying bills or covering healthcare expenses. A robust long-term care insurance plan, combined with understanding your disability support benefit, ensures peace of mind.

Optimist You:

“Oh, sure! Understanding the jargon sounds easy enough!”

Grumpy Me:

“Yeah, right… until you spend hours deciphering what ‘elimination period’ even means.”

How Do You Effectively Leverage Disability Support Benefits? Let’s Walk Through It.

If you’re ready to take control of your financial future, here’s a step-by-step roadmap:

Step 1: Review Your Current Policies Thoroughly

Dig deep into any existing insurance plans. Look for mentions of disability support benefits. If your employer offers group coverage, ask HR for specifics—they may surprise you!

Step 2: Assess Your Risk Profile

Are you prone to chronic conditions? Family history matters here. Tools like online risk calculators give you ballpark estimates.

Step 3: Compare Multiple Plans

Don’t settle for the first option. Get quotes from multiple providers and compare features side by side. Remember, cheaper doesn’t always mean better.

P.S.: Terrible Tip Alert!

Some blogs say skipping riders saves money. Bad idea! Riders like inflation protection ensure your benefits keep pace with rising costs.

Pro Tips for Maximizing Your Disability Support Benefits

- Educate Yourself: Read every word of your policy documents—even the fine print.

- Consult Professionals: Talk to a licensed advisor who specializes in long-term care insurance.

- Save Receipts: Document all related medical expenses for tax purposes.

| Tactic | Description | Impact |

|---|---|---|

| Policy Review | Regularly audit your insurance portfolio. | Ensures optimal coverage. |

| Rider Inclusions | Add-ons tailor-made for needs. | Prevents future loopholes. |

Comparison of tactics for managing long-term care insurance effectively.

Success Stories: When Planning Pays Off Big Time

Meet Sarah. At 48, she developed fibromyalgia, rendering her unable to perform daily tasks, let alone work full-time. Thankfully, Sarah had invested in a solid long-term care policy years prior, complete with a substantial disability support benefit. This allowed her to access monthly payments, pay caregivers, and focus on healing instead of worrying about finances.

FAQs About Disability Support Benefits

Q: Can I claim both SSDI and disability support benefits?

Yes, but check your policy’s coordination-of-benefits clause to avoid double-dipping penalties.

Q: How soon does the disability support benefit kick in?

It depends on the elimination period specified in your plan, usually ranging from 30 to 180 days.

Q: Are there age restrictions?

Most plans require enrollment before age 60; however, some high-risk cases might qualify beyond that.

Conclusion

Navigating long-term care insurance and your disability support benefit isn’t rocket science—but it sure feels like it sometimes. With knowledge comes power, so equip yourself with these insights to secure a brighter financial tomorrow.

And hey, don’t forget to share this guide with friends—it’s chef’s kiss advice wrapped in SEO goodness.

*Like a Tamagotchi, your insurance game thrives on daily TLC.* 🌱💚

**Note**: Replace placeholder image URLs (`https://example.com`) with actual high-quality images relevant to the content, ensuring proper licensing.